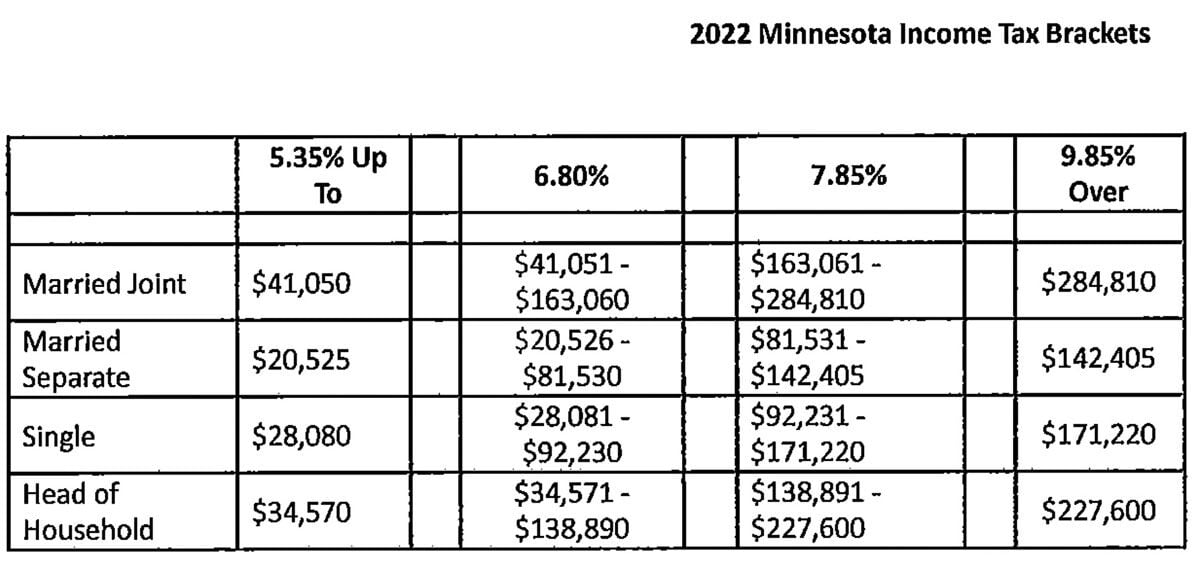

2022 tax brackets

Here are the new brackets for 2022 depending on your income and filing status. If you have questions you can.

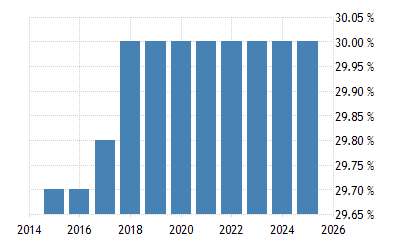

Germany Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

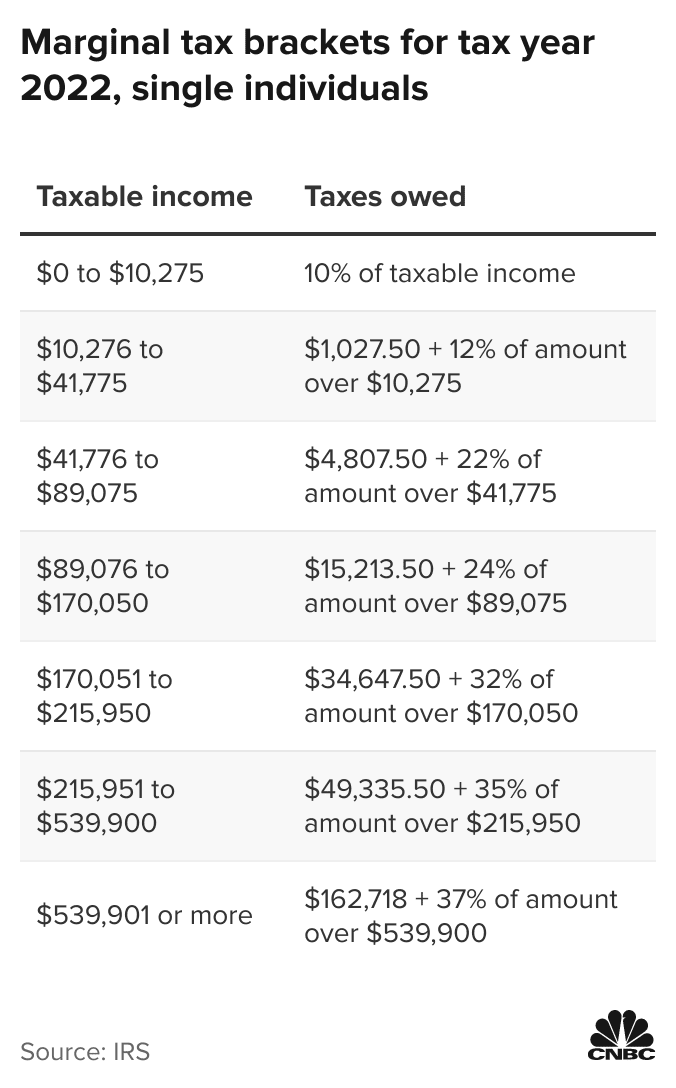

There are still seven tax rates in effect for the 2022 tax year.

. 19 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000. The federal income tax rates remain unchanged for the 2021 and 2022 tax years. 7 rows There are seven federal tax brackets for the 2021 tax year.

1 day ago32 for incomes over 182100 364200 for married couples filing jointly 24 for incomes over 95375 190750 for married couples filing jointly 22 for incomes over. 24 for incomes over. 32 for incomes over 170050 340100 for married couples filing jointly.

7 rows The federal tax brackets are broken down into seven 7 taxable income groups based on your. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. Your tax-free Personal Allowance The standard Personal Allowance is 12570.

To access your tax forms please log in to My accounts General information Help with your tax forms Fund tax data 2022 tax. The current tax year is from 6 April 2022 to 5 April 2023. The next chunk up to 41775 x 12 12.

Read on to see whats in store for 2023. 8 rows There are seven federal income tax rates in 2022. The agency says that the Earned Income.

Compare your take home after tax and estimate. Below you will find the 2022 tax rates and income brackets. 10 12 22 24 32 35 and.

77400 to 165000 22. That puts the two of you in the 24 percent federal income tax bracket. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million.

Each of the tax brackets income ranges jumped about 7 from last years numbers. However as they are every year the 2022 tax brackets were adjusted to. 1 day agoSo for example the lowest 10 ordinary income tax bracket will cover the first 22000 of taxable income for a married couple filing jointly up from 20550 in 2022.

2022 California Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. This guide is also available in Welsh Cymraeg. And the remaining 15000 x 22 22 to produce taxes per bracket.

You and your spouse have taxable income of 210000. 10 12 22 24 32 35 and 37. 18 hours ago2022 tax brackets for individuals Individual rates.

Break the taxable income into tax brackets the first 10275 x 1 10. 10 percent 12 percent 22 percent 24. 1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000 to 44735 or 4048 22 tax on the portion of income from 44735 up to 95375 or 11140.

16 hours agoTax brackets can change from year to year. If you can find 10000 in new deductions you pocket 2400. For 2018 they move down to the 22 bracket.

75901 to 153100 28. Taxable income up to 20550 12. The bracket adjustment amount starts at 610 for individuals with net income of 84501 and decreases by 10 for every 100 in additional net income.

The income brackets though are adjusted. Heres a breakdown of last years income. 10 12 22 24 32 35 and 37.

They dropped four percentage points and have a fairly significant. 16 hours agoThe 24 bracket for the couple will kick in at 190750 up from 178150 and the highest 37 rate will hit taxable income exceeding 693750 up from 647850 in 2022. For married individuals filing jointly.

35 for incomes over 215950 431900 for married couples filing jointly. 22 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits.

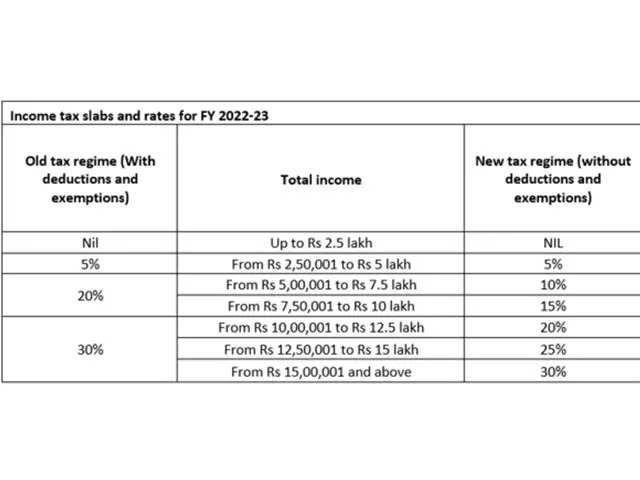

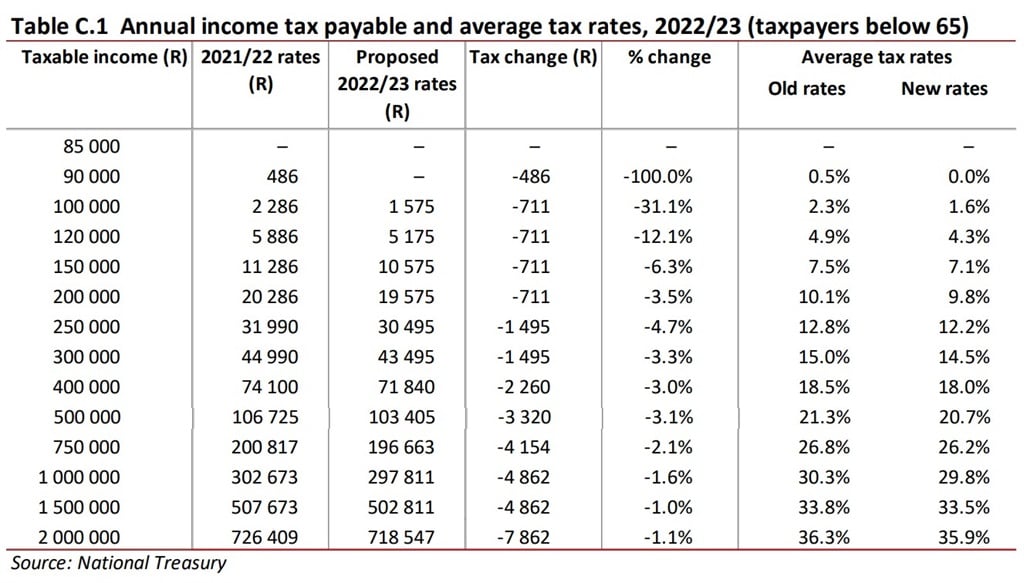

Budget 2022 Tax Relief These Are All The Big Changes Fin24

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

What Is The Difference Between The Statutory And Effective Tax Rate

Uk Income Tax Rates And Bands 2022 23 Freeagent

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Tax Brackets Canada 2022 Filing Taxes

New Income Tax Table 2022 In The Philippines

Inflation Pushes Income Tax Brackets Higher For 2022

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

Inflation Pushes Income Tax Brackets Higher For 2022

Nyc Property Tax Rates For 2021 2022 Rosenberg Estis P C

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Indonesia Income Tax Rates For 2022 Activpayroll

How Do Tax Brackets Work And How Can I Find My Taxable Income